open end mortgage bonds

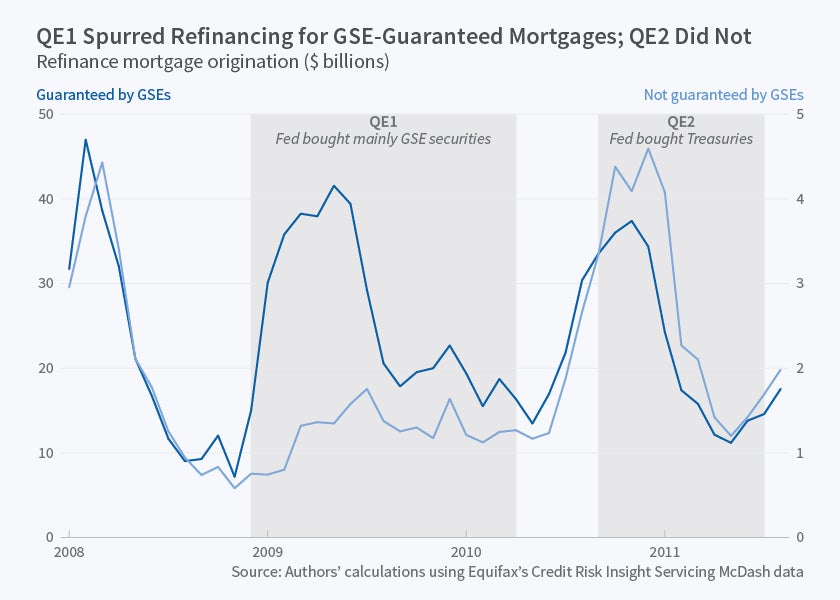

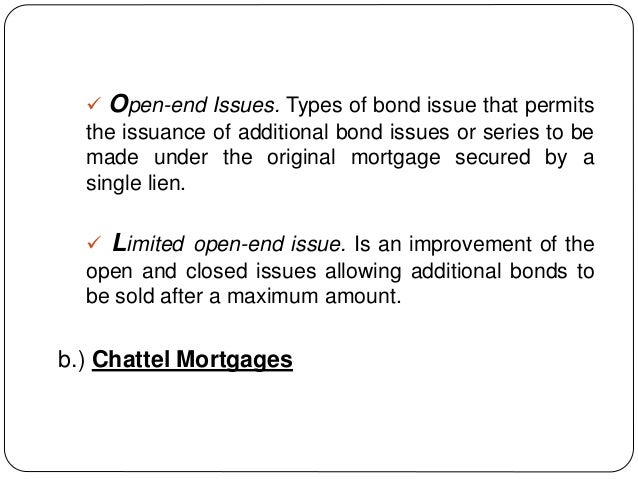

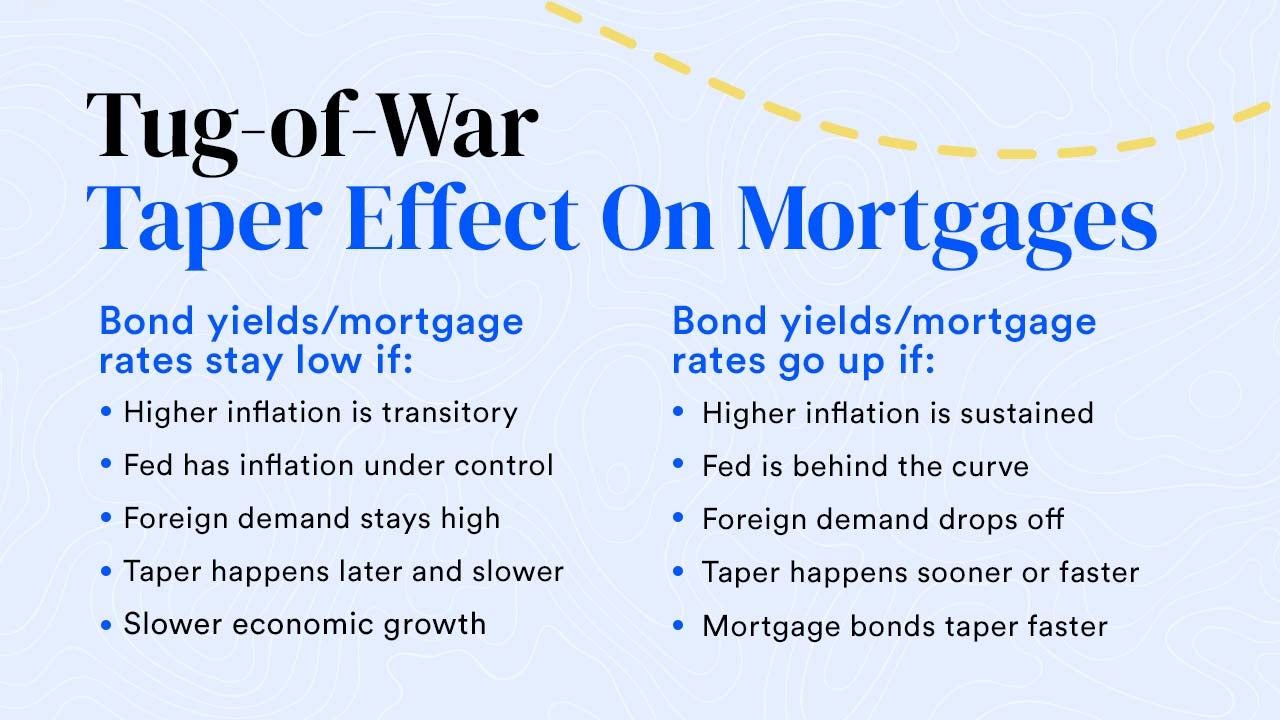

An even more conservative version is the limited open-end mortgage which usually contains the same restrictions as the open-end but places a limit on the amount of first mortgage bonds. As part of its bold and open-ended plan the Fed said it would spend 40 billion a month to buy mortgage bonds to make home buying more affordable.

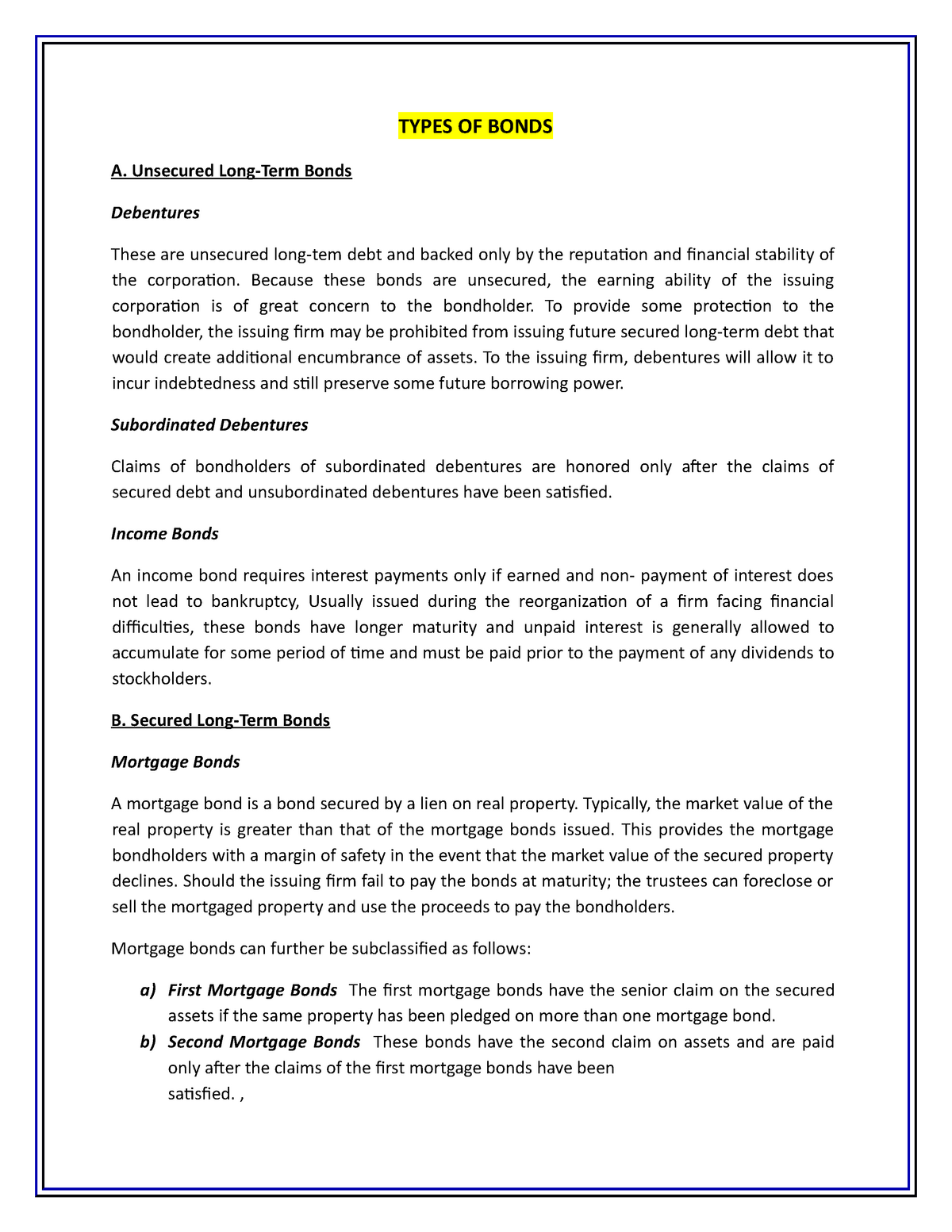

Types Of Bonds Types Of Bonds A Unsecured Long Term Bonds Debentures These Are Unsecured Long Tem Studocu

10 hours agoNow heres a rare thing.

. Mortgage rates managed to move lower on average for the 2nd consecutive business day on Monday. Chase is a relative term considering the big. Bail Bonds 631 256.

Alternatively an open-end mortgage bond is one that allows the same assets to be used as security in future issues. If the amount of additional bonds is restricted the mortgage is referred to as a limited. Big Trouble Bail Bonds Agency.

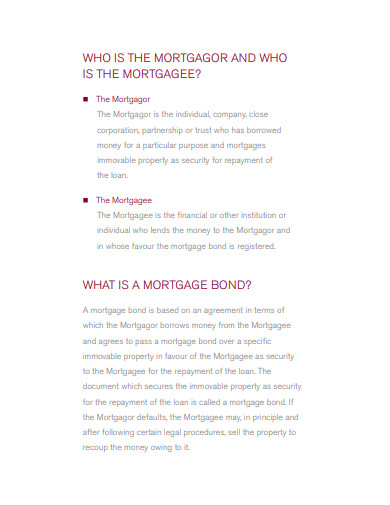

An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related. - An Open-end Mortgage Bond issued by a corporation is one in which the property used to secure the bonds can be used to secure additional bonds and all bonds rank equally. YEARS IN BUSINESS 631 256-5338.

Definition in the dictionary English. 1 Patchogue-Medford voters rejected a 45 million bond proposal 466-560 Newsday reported. This type of mortgage.

A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender. YEARS IN BUSINESS 631 234-2663. Match all exact any words.

A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement. Big Trouble Bail Bonds Agency. View all businesses that are OPEN 24 Hours.

Affordable Bail Bonds Inc. Open-end mortgage saves borrower the. Posted Thu Oct 20 2022 at 1038 am ET.

10 hours agoSellers succeeded in pushing yields up to 4291 before short-covering trades chased the EU rally into the noon hour. - An Open-end Mortgage Bond issued by a corporation is one in which the property used to secure the bonds can be used to secure additional bonds and all bonds rank equally. Peggy Spellman Hoey Patch Staff.

In an 111 vote the Federal Reserve decided to. Notes that have been reaffirmed by borrowers original signatures on a copy. D Are reaffirmed Notes and Lost Instrument Bonds LIB acceptable for missing prior Notes in NY CEMAs.

La Fed dijo que gastará 40000. Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit. That hasnt happened for roughly 3.

Check open-end mortgage bond translations into French. A mortgage that permits the issuer to sell additional bonds under the same lien. 138 Mount Vernon Ave.

A bond that can be changed into a specified number of shares of the issuers common stock is called a.

Hits Keep Coming For Mortgage Market The Bad Kind

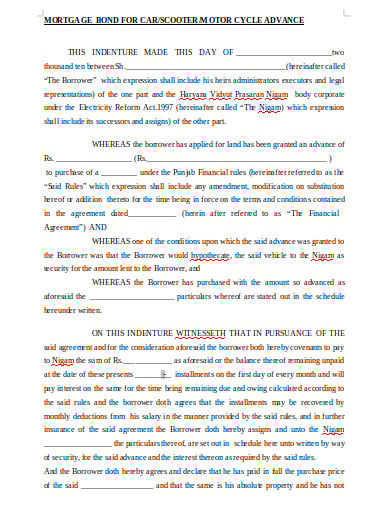

11 Mortgage Bond Templates In Pdf Doc Free Premium Templates

What Is An Open End Mortgage Supermoney

:max_bytes(150000):strip_icc()/bond.asp_final-76c865e23abe4f6c9e7c41a38cfe6e39.png)

Bond Financial Meaning With Examples And How They Are Priced

Types Of Bonds Bond Yield Ppt Download

What Does The Federal Reserve Mean When It Talks About Tapering

11 Mortgage Bond Templates In Pdf Doc Free Premium Templates

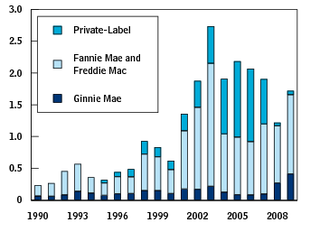

How Quantitative Easing Affected Mortgage Refinancing Nber

What Is A Mortgage Bond Rocket Mortgage

Primer On Agency Mortgage Backed Securities Specified Pools And Their Convexity Profiles The Journal Of Fixed Income

Classes Of Bonds Classification Of Bonds As To Type

Taper Explained How The Fed Plans To Slow Its Bond Purchases Without Wrecking The Economy Bankrate

Mortgage Backed Security Wikipedia

:max_bytes(150000):strip_icc()/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

Historical Mortgage Rate Trends Bankrate

Open End Mortgages A Comprehensive Guide Smartasset

11 Mortgage Bond Templates In Pdf Doc Free Premium Templates

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)